reverse sales tax calculator california

That entry would be 0775 for the percentage. Enter the sales tax percentage.

ميت يتصعد ساحر Tax Calculator Usa California Philosophyinpractice Net

OP with sales tax OP tax rate in decimal form 1 But theres also another method to find an items original price.

. Reverse Sales Tax Calculator Software Cleantouch General Production System v10 Accounting Inventory Formula Based Production Sales Tax System After keeping study of various Production Units working here in Pakistan experts of Cleantouch designed Cleantouch General Production System to fulfill the needs of the units in simple manners. Free online 2021 reverse sales tax calculator for Brownsville California. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to California local counties cities and special taxation districts.

Not all products are taxed at the same rate or even taxed at all in a given municipality. The reverse sales tax calculator is the easiest and very handy calculator for computing the actual price if you input the sales tax rate and the sale price you paid for a good or service. This is especially beneficial if you have to list your out-of-state purchases to you current state of residence and the taxes paid on those purchases.

Price Before Tax Final Price 1Sales Tax100 Tax Amount Final Price - Price Before Tax. A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Never Worry About Sales Tax Again.

For instance in Palm Springs California the total sales tax percentage including state county and local taxes is 7 and 34 percent. This Income Tax Calculator shows current and past tax brackets and estimates federal tax for years 2000-2012. The Harmonized Sales Tax or HST is a sales tax that is applied to most goods and services in a number of Canadian provinces.

Finding how much sales tax you paid on an article is quite easy but knowing the actual cost requires a reverse calculation. Additional Business Financial Calculators Available. Please check the value of Sales Tax in other sources to ensure that it is the correct value.

Usually the vendor collects the sales tax from the consumer as the consumer makes a purchase. Californias base sales tax is 725 highest in the country. Tax 3225 0075.

A Reverse Sales Tax Calculator is useful if you itemize your deductions and claim overpaid local and out-of-state sales taxes on your taxes. All you have to input is the amount of sales tax you paid and the final price on your. California City County Sales Use Tax Rates effective April 1 2022 These rates may be outdated.

How to Calculate Reverse Sales Tax. Subtract the dollars of tax from step 2 from the total price. Economic Calculator Reference Page.

52 rows This reverse sales tax calculator will calculate your pre-tax price or amount for you. Now find the tax value by multiplying tax rate by the before tax price. PRETAX PRICE POSTTAX PRICE 1 TAX RATE Common Mistakes.

Order Now Offer Details. Tax 242 tax value rouded to 2 decimals. Input the Tax Rate.

Our Reverse Sales Tax Calculator accepts two inputs. Reverse Sales Tax Calculator Remove Tax. For a list of your current and historical rates go to the California City County Sales Use Tax Rates webpage.

California City County Sales Use Tax Rates effective January 1 2022 These rates may be outdated. The only thing to remember about claiming sales tax and tax forms is to save every receipt for every purchase you intend to claim. HST reverse sales tax calculation or the Harmonized reverse Sales Tax calculator of 2022 for the entire Canada Ontario British Columbia Nova Scotia Newfoundland and Labrador and many more Canadian provinces.

Reverse Sales Tax Calculator Calculating Sales Tax. It includes an option of different filing status and shows average tax - the percentage of tax paid relatively to your total taxable income. Firstly divide the tax rate by 100.

Take the total price and divide it by one plus the tax rate. A Reverse Sales Tax Calculator is very useful for tax purpose because if you itemize your deductions and claim credit for the overpaid local and out-of-state sales taxes on your taxes. 75100 0075 tax rate as a decimal.

Since many cities and counties also enact their own sales taxes however the actual rate paid throughout much of the state will be even higher. We can not guarantee its accuracy. Formulas to Calculate Reverse Sales Tax.

Enter the total amount that you wish to have calculated in order to determine tax on the sale. Tax Amount Original Cost - Original Cost 100 100 GST or HST or PST. In most countries the sales tax is called value-added tax VAT or goods and services tax GST which is a different form of consumption tax.

Reverse Sales Tax Formula. Input the Final Price Including Tax price plus tax added on. That means that regardless of where you are in the state you will pay an additional 725 of the purchase price of any taxable good.

Instead of using the reverse sales tax calculator you can compute this manuallyTo find the original price of an item you need this formula. Look up the current sales and use tax rate by address. Multiply the result from step one by the tax rate to get the dollars of tax.

To easily divide by 100 just move the decimal point two spaces to the left. Reverse Sales Tax Calculator - 100 Free - Calculatorsio. Following is the reverse sales tax formula on how to calculate reverse tax.

This script calculates the Before Tax Price and the Tax Value being charged.

ميت يتصعد ساحر Tax Calculator Usa California Philosophyinpractice Net

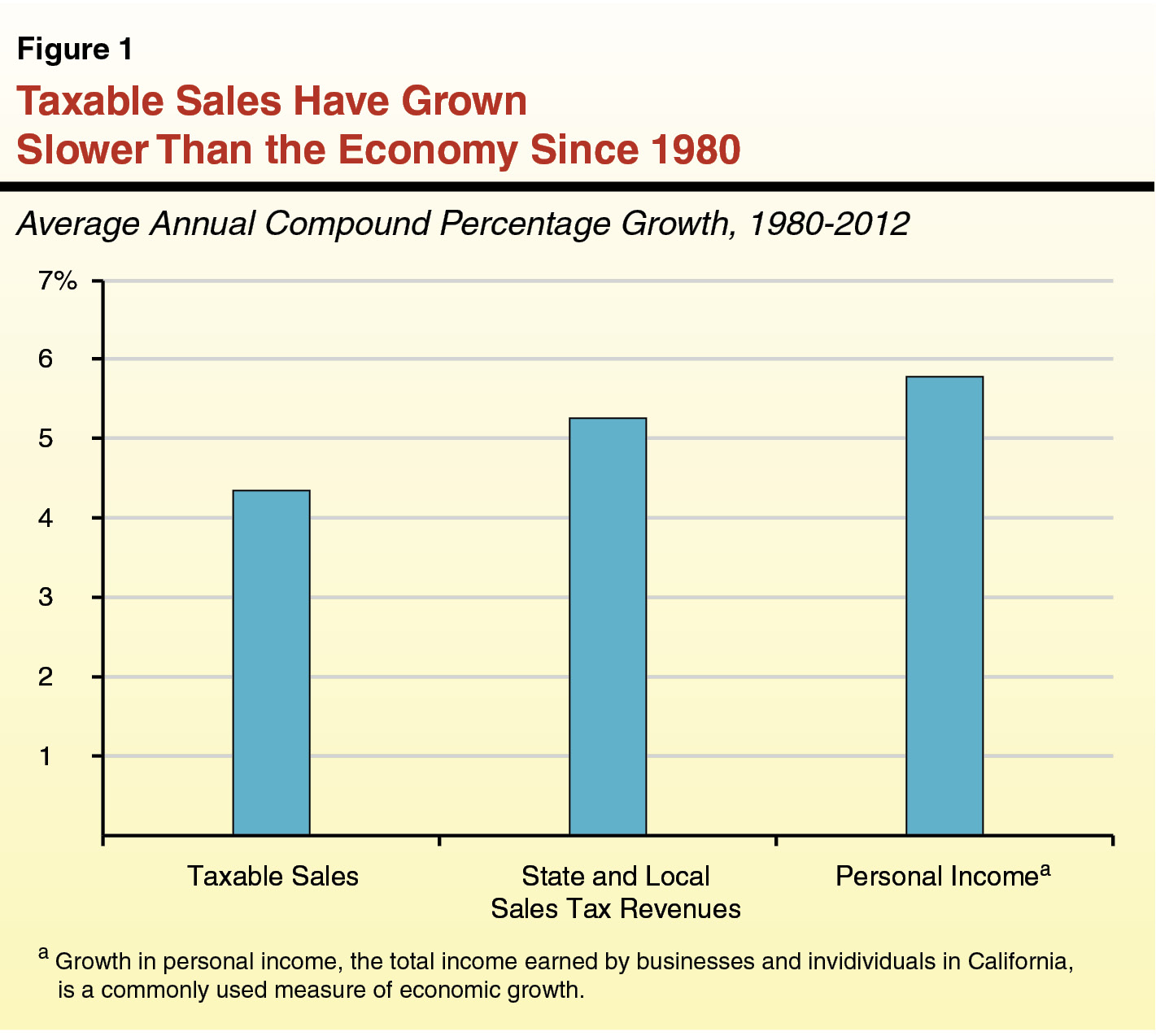

Why Have Sales Taxes Grown Slower Than The Economy

ميت يتصعد ساحر Tax Calculator Usa California Philosophyinpractice Net

How To Calculate Sales Tax Backwards From Total

Us Sales Tax Calculator Reverse Sales Dremployee

California Sales Tax Calculator Reverse Sales Dremployee

Cryptocurrency Taxes What To Know For 2021 Money

Sales Tax Reverse Calculator Internal Revenue Code Simplified

ميت يتصعد ساحر Tax Calculator Usa California Philosophyinpractice Net

California Sales Tax Calculator Reverse Sales Dremployee

ميت يتصعد ساحر Tax Calculator Usa California Philosophyinpractice Net

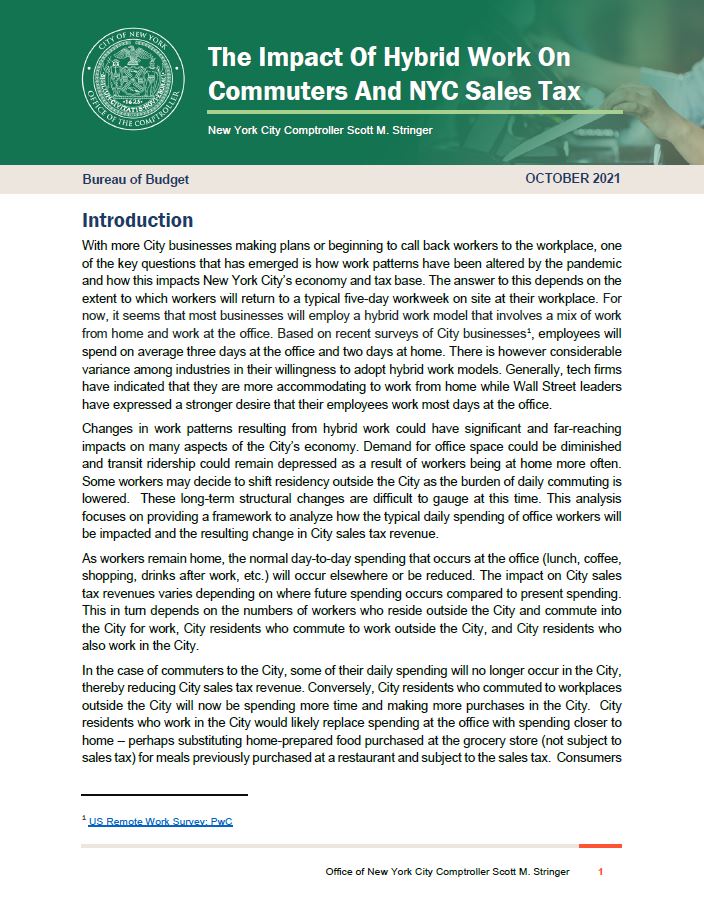

The Impact Of Hybrid Work On Commuters And Nyc Sales Tax Office Of The New York City Comptroller Brad Lander

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

How To Calculate Sales Tax Backwards From Total

Reverse Sales Tax Calculator De Calculator Accounting Portal

How To Calculate Sales Tax In Excel Tutorial Youtube

Qb Online Has Changed It Sales Tax Processing It Does Not Work For Me Is Anyone Else Having Problems With New Sales Tax System

Sacramento County Sales Tax Rates Calculator

Qb Online Has Changed It Sales Tax Processing It Does Not Work For Me Is Anyone Else Having Problems With New Sales Tax System